By Felix Khanoba

The Federal Competition and Consumer Protection Commission, FCCPC, raked in N56 billion as Internally Generated Revenue in 2023.

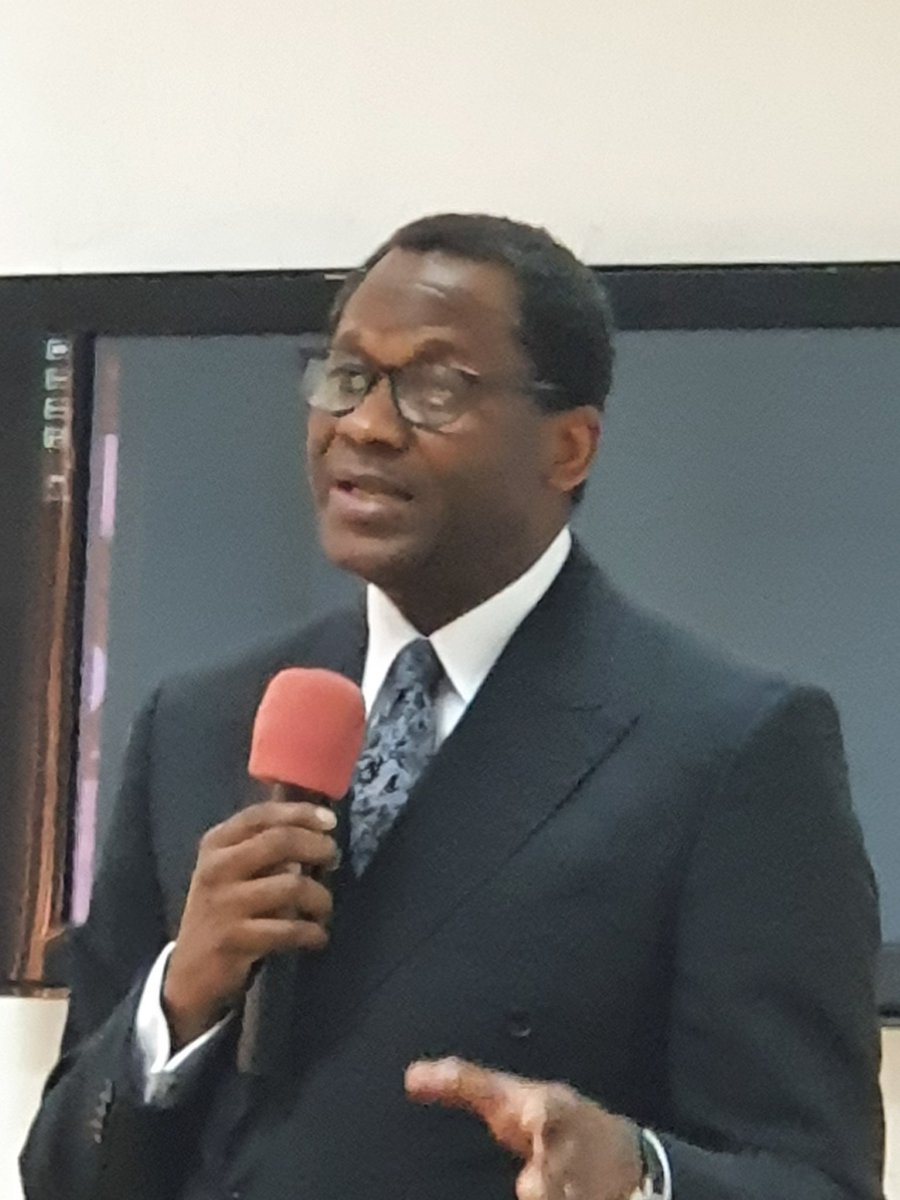

The Executive Vice Chairman of FCCPC, Babatunde Irukera, made this known on Thursday at a media parley in Abuja.

Speaking at the event which had its theme as : ‘Reflections on the road so far, and road ahead’, the FCCPC boss

revealed that 90 percent of the generated revenue was raised from penalties and that N22.4 billion was remitted to the Federal Government.

He noted that businesses must be held accountable and appropriate consequences when they err.

“What makes the market stable is holding businesses accountable. The consequence management system is what we have adopted.

“We are not trying to close down businesses but they must know that if you snooze, you loose.

“You cannot distort the market and expect that there will be no consequences,” he said.

While analysing the Commission’s budget since 2017, Irukera said the agency got N1 billion as budget from the government and raked an IGR of N154 million in that year.

According to him, the Commission received N3.3 billion, N1.3 billion as government budget in 2018 and 2019 respectively and N377 million as IGR in 2019.

The executive vice chairman explained that in 2020, the Commission’s budget from the government was N887 million and it got an IGR of N864 million.

“By 2021, the government approved a budget of N1.8 billion to the Commission and the agency generated N4 billion and remitted N1.6 billion.

“In 2022, the government budget was N1.3 billion for the agency, the agency did not touch a single kobo of the operational or capital expense, the agency made N5.2 billion and remitted N2.6 billion,” Irukera said.

He added that the Commission had since January 1, vacated the Federal Government’s budgetary provisions.

He restated the need for companies to take responsibility and create their stand-alone complaints resolution platforms to resolve consumer-related issues.

On the harassment of customers by digital money lenders, the Irukera said the Commission has reduced such menace by 80 percent.

He said the desire and aspiration of the Commission was to eliminate the defamatory messages, intrusion on people’s privacy and achieve more ethical lending.

Irukera said that although there were still pockets of violators, the Commission would not relent in sanitising the space, adding that as a regulator , the Commission understands their course and balance it against their desires.

”Some of the lenders used to tell us that when we call a borrower now, they send us your photograph and a statement by FCCPC but that is not right.

”But I tell them, tell your problems to God, my mandate is to protect consumers but I understand that we also have a mandate in protecting consumers to preserve business.

”If we allow businesses to die, it is a failed approach to consumer protection.

”Nigeria is struggling with digital lending.This is a struggle that is not isolated to us alone.

”India, Kenya, Brazil, Ghana, Uganda are still struggling in digital lending. Some of these countries are taking lessons from what we have done,” he said.

On the scorecard of the Commission, Irukera said there was still much to be done to ensure a balanced market to the protection of citizens.

”The road ahead is far more so, we will keep doubling our efforts.”